Forex trading is a modern investment method among Singaporeans. FX, forex or foreign exchange is quickly buying or selling currencies from different countries.

The many benefits that come with forex trading are often enough to convince even those with little financial knowledge to invest their money. However, before you start your foray into forex trading, choosing a strategy that best suits your skills and goals is crucial.

Key factors when choosing a forex trading strategy

Here are some points to consider when choosing a forex trading strategy in Singapore:

Consider your risk appetite

Different trading strategies come with varying levels of risk. If you are not comfortable taking risks, you should choose a less risky strategy. If you are comfortable taking risks, you can choose a more aggressive strategy.

Set your investment horizon

Your investment horizon is the timeframe you expect to see a return on your investment. Choose a less risky strategy with a lower potential return if you have a short investment horizon. You can afford to take on more risk and consider a more aggressive strategy for a long investment horizon.

Choose an indicator-based strategy if you have no previous experience

The market forecast made by professional foreign-exchange traders always includes indicators like support levels, resistance levels, moving averages and oscillators, along with a trading strategy to take advantage of the market forecast.

If you have no previous experience with forex or trading, choosing an indicator-based strategy would be your best option. Indicators help users predict the future price movement and entry and exit points for a particular currency pair. In addition, indicators provide information on starting as a beginner in forex.

Choose a technical analysis-based strategy if you have some experience

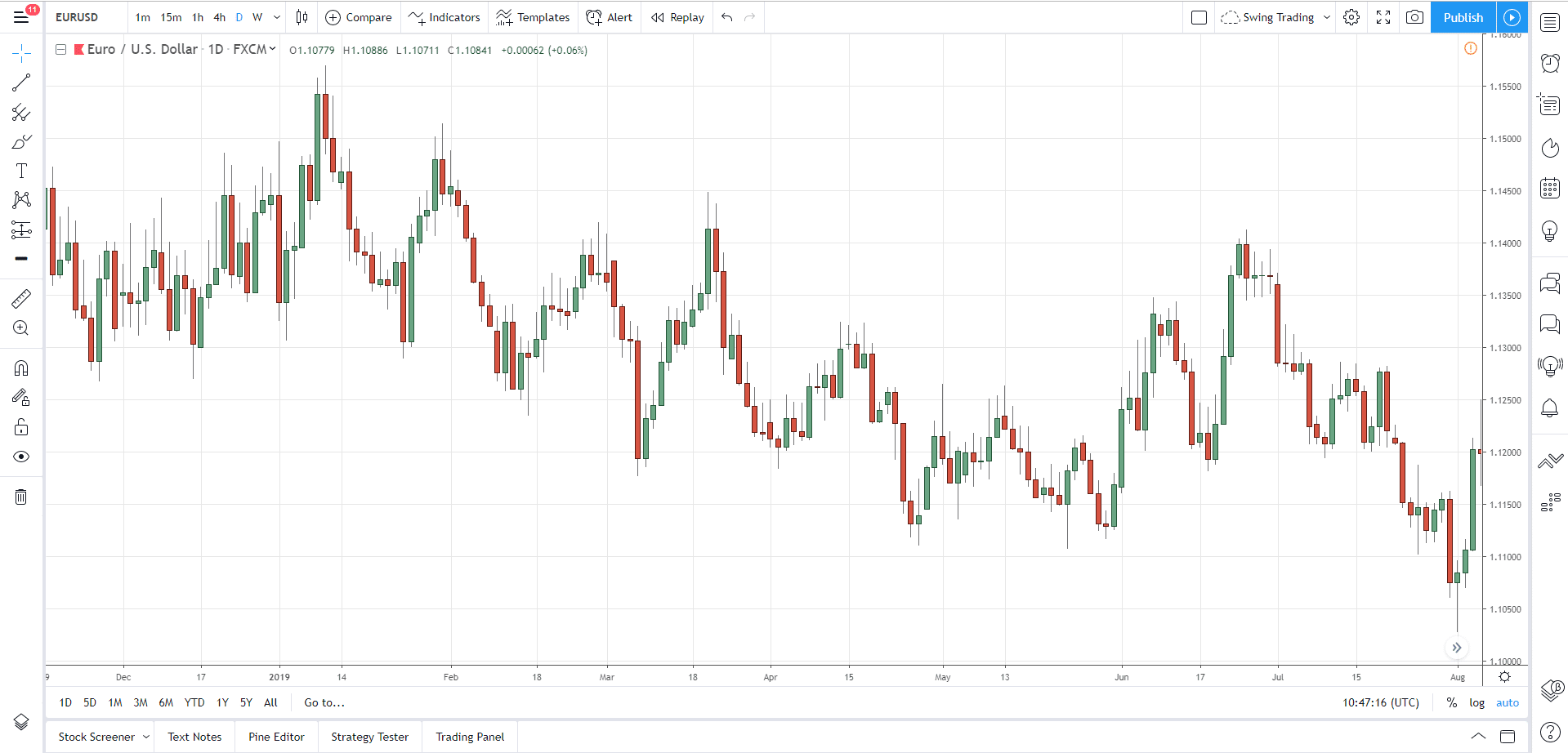

Technical Analysis (TA) helps foreign exchange traders identify opportunities based on charts prepared by professionals which do not contain any third party indicators. It is only through patterns and trend lines that traders can look out for potential opportunities to maximise their earnings from exchanges between two currencies. Examples of patterns include the double top, wedge and diagonal triangle.

Forex trading involves speculation when it comes to predicting future market movements. Thus, if you’re looking for an accurate prediction of market movement probabilities based on past performance data, then technical analysis-based strategies are probably more suitable for you.

The best strategy is a combination of both indicators and TA.

By using the best of both worlds (indicators and TA), traders can expect high returns from their investments since signals will be easy to find, therefore making transactions quick and efficient.

The downside, however, would be that though the possibilities are endless with this strategy, one needs an in-depth knowledge of how indicators work and awareness about chart reading to make the most out of analysis using both indicators and TA.

Choose a strategy that has consistent results

The number one reason traders lose money is that they don’t follow their trading plan or strategy. If you want to avoid this scenario, then choosing a forex trading strategy that has worked for others in the past will help ensure your success in Singapore. Remember, if it isn’t right for you, there are other options out there!

In conclusion

There are many different types of forex traders available, and each one has its own unique set of requirements. There are various forex trading strategies to choose from to cater to all these different traders. When making your decision, it is essential to consider all the different important factors. By doing so, you can be sure that you are using a strategy that is best suited for your individual needs. If you are a new investor, it is recommended to contact a reputable online broker from Saxo Bank.